What is tally?

Tally is an enterprise resource planning (ERP) accounting software used mainly in Micro, Small and Medium enterprises to record the day-to-day business data of a company. The advantage of this software is it can easily integrate with other business applications like sales, payroll finance, etc.

Tally is a popular accounting software used in many countries, including India. Tally is a digital accounting format, and the entries are maintained similarly to the manual, a book of accounts.

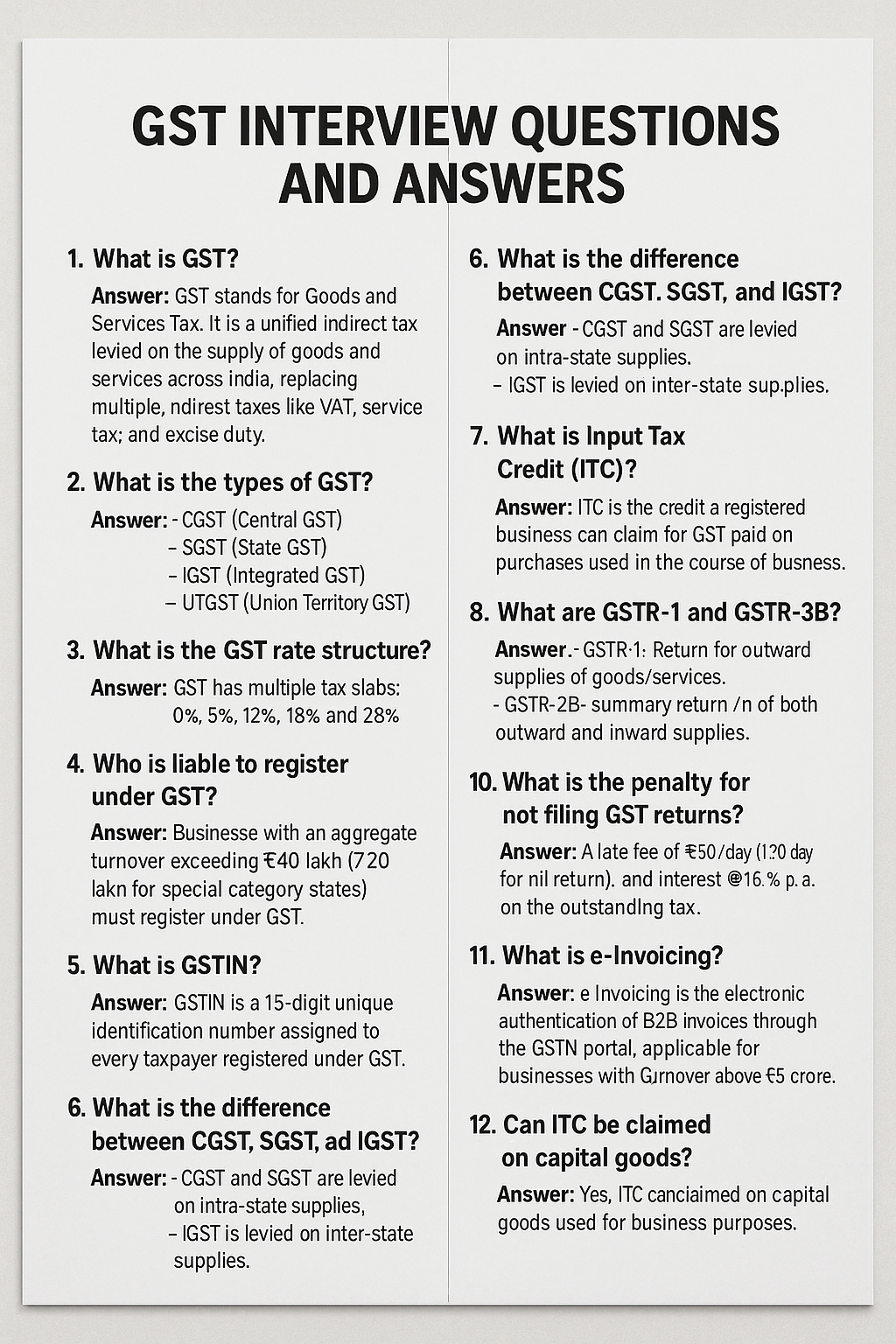

What are the different types of GST

GST are four types of GST: central GST (CGST), state GST (SGST), integrated GST (IGST) and union territory GST (UTGST). CGST and SGST apply to intra-state transactions, with the central and respective state governments splitting the revenue between them. IGST is a levy on inter-state transactions and imports, with the revenue going to the central government. UTGST is similar to SGST but applies in union territories that do not have a state legislature.

What are the objectives of the GST

Bringing uniformity in taxes, remove multiple indirect taxes, prevent tax evasion and fraud, regulate the unorganized section of the economy, simplify tax filing process, optimize supply chain.

What Are The Components Of GST

GST has a dual effect at the central and state levels as it operates on a common tax base. The centre levies a tax on intra-state supply of goods and services which is known as the Central GST or CGST. States levy GST on some goods and services which is State GST or SGST. The centre also collects an Integrated GST or IGST on inter-state supply of goods and services.

Central Goods and Services Tax (CGST)

CGST replaces the taxes that the central government levies, like surcharges, central excise duty and cess. If a manufacturer produces and sells a product within a state, both CGST and SGST can apply to it. The state receives the SGST and the centre receives the CGST component of the taxes. The maximum CGST rate is 14%. While the GST council may levy a 2.5% tax on household items, it may levy a 14% CGST on air conditioners, refrigerators and luxury items.

State Goods and Services Tax (SGST)

State governments levy and collect GST known as State GST or SGST. SGST is applicable for supply and sale of goods and services which happen within the boundaries of a state. State governments charge SGST on the value of a transaction that a buyer pays for. SGST slabs may vary as the states fix their own tax rates.

Integrated GST (IGST)

Integrated GST or IGST is a tax that is applicable for transactions between two states. IGST is applicable on supply of goods and services between two states and on imports and exports. The central government collects the tax revenue and shares a portion of it with state governments.

Union Territory GST (UTGST)

Union Territory GST is the GST applicable on transactions of goods and services in the Union Territories. Typically, these GST rates provide goods and services at a very nominal rate, as Union Territories are exempt from central government taxes. This enhances the potential for developing tourism and business in a Union Territory.

What are the tax slabs under GST?

The GST council recommends GST slab rates for different categories of items. They periodically review the slabs, considering the demands of the market and industries. They fix a slab to ensure that essential commodities have lower tax rates, while luxury goods and services fall under higher GST slabs. The GST slabs rates are under 0%, 5%, 12%, 18% and 28%. Some essential food and other necessary items have exemptions from GST.

What is the significance of the GST Identification Number (GSTIN)?

GSTIN is a unique 15-digit alphanumeric code that every registered taxpayer receives under the GST regime. It helps in identifying taxpayers and ensuring proper compliance with GST regulations. GSTIN is mandatory if a company wants to file GST returns, generate e-way bills and avail of input tax credits (ITC). It also helps tax authorities track and monitor business transactions, making tax administration more efficient and transparent.

What are the various accounting ledgers businesses maintain under GST?

Under the GST regime, businesses maintain three primary ledgers: the Electronic Liability Register, the Electronic Credit Ledger and the Electronic Cash Ledger. The Electronic Liability Register records a taxpayer’s GST liabilities, including tax, interest, penalty and other dues. The Electronic Credit Ledger keeps track of the ITC available to taxpayers to offset GST liabilities. Lastly, the Electronic Cash Ledger records all cash payments a taxpayer makes, such as tax, interest, penalty and other payments.

How does ITC work under GST?

ITC forms an integral part of the GST system, helping to prevent a tax on tax, or the cascading effect of taxes, and enhance economic efficiency. When answering this question, describe the basic working principle of ITC and how it impacts the overall tax liability.

Example: ITC under GST refers to the tax that businesses pay on a purchase, which they can use to reduce their tax liability when they make a sale. For example, if a business pays a GST of ₹200 on raw materials and charges a GST of ₹500 on the final product, it can deduct the ₹200 from the ₹500, making the actual GST liability ₹300. This mechanism helps prevent the cascading effect of taxes.

What is the difference between a zero-rated supply and an exempt supply?

Hiring managers often ask this question to assess your understanding of different supplies under GST. Differentiating between zero-rated and exempt supplies helps businesses accurately determine their tax implications. When answering this question, explain the distinction between these two types of supplies and their impact on GST.

Example: In GST, a zero-rated supply refers to the goods or services that are taxable but have a GST rate of 0%. The government does not levy any GST on such supplies, but businesses can claim ITC on inputs they use for zero-rated supplies. An exempt supply refers to the supply of goods or services that are entirely exempt from GST, meaning the government does not charge any GST, and businesses cannot claim ITC on inputs they use for these supplies.

Explain the concept of destination-based taxation in the context of GST

Destination-based taxation helps determine the taxing authority and the location of the tax collection. When answering this question, provide a clear and concise explanation of destination-based taxation in the context of GST.

Example: Destination-based taxation is a core principle of GST that focuses on the consumption of goods and services. Under this concept, the government levies and collects taxes at the destination or the point of consumption. In the context of GST, the state where businesses or individuals consume the goods or services gets the tax revenue. This approach ensures a fair and efficient distribution of tax revenues among states and encourages economic activity at the destination, which benefits the consuming state.

What are the penalties for non-compliance with GST rules?

This question seeks to evaluate your familiarity with GST regulations and their enforcement. If you want to work with GST, having a thorough understanding of the penalties for non-compliance can help you be more effective in your role. When answering this question, explain the various consequences a business may face in cases of non-adherence to the GST rules.

Example: Non-compliance with GST rules can result in several penalties and actions by the authorities. If a business fails to register for GST, it may face a penalty of up to ₹10,000 or 10% of the tax due, whichever is higher. The penalty can be 100% of the tax amount for not issuing an invoice or providing a false invoice. Non-payment or short tax payment also results in substantial fines. Complying with GST rules helps businesses avoid these penalties and legal consequences.

What is the treatment of exports and imports under GST?

Hiring managers want to evaluate your knowledge of GST regulations and your understanding of the handling of exports and imports within the GST framework. To answer this question, provide a concise explanation of the treatment of exports and imports under GST. Highlight your awareness of the documentation requirements and specific procedures for exports and imports under GST.

Example: The treatment of exports and imports is different under GST. The authorities consider exported goods or services to be zero-rated supplies, meaning that there is no GST charge on them. Exporters can claim a refund of any GST they pay on inputs they use for the export. There is an IGST levy on imported goods or services, including the central and state components of GST. Importers can claim ITC on the IGST they have paid when filing their GST returns. Proper documentation, such as invoices and customs declarations, is mandatory for exports and imports to ensure compliance with GST regulations.

How is the composition scheme beneficial for small businesses under GST?

The composition scheme aims to simplify GST for small businesses by reducing the burden of compliance. When answering this question, highlight the primary advantages of this scheme for small businesses.

Example: The composition scheme offers several advantages to small businesses to support their operations. Firstly, it simplifies the compliance process by reducing the amount of paperwork and record-keeping requirements. Small businesses can pay tax at a lower rate based on their turnover, which helps reduce their tax liability. Additionally, the composition scheme does not require businesses to maintain detailed records, making it easier for them to manage their finances. This scheme enables small businesses to compete effectively in the market by providing them with a favourable tax structure, allowing them to focus on their growth and operations.

What is a reverse charge mechanism (RCM) in GST?

RCM changes the usual flow of tax payments and helps increase tax compliance.

Example: Under GST, RCM is a method where the receiver of goods or services becomes liable to pay the tax instead of the supplier. This is a shift from the typical practice where the supplier pays the tax on supply. RCM aims to increase tax compliance and revenue by ensuring tax collection on each supply. Under RCM, the receiver pays the tax to the government and can claim it back later as ITC when it uses the goods or services for business purposes.